Firms and markets II

Materials for class on Thursday, October 17, 2019

Contents

Slides

Download the slides from today’s class.

Supply, demand, surplus, deadweight loss, and taxes

In class, we looked at these different supply and demand graphs and calculated the areas of the different rectangles and triangles. Here are the answers for all five (the first general one, followed by the four with varied elasticity):

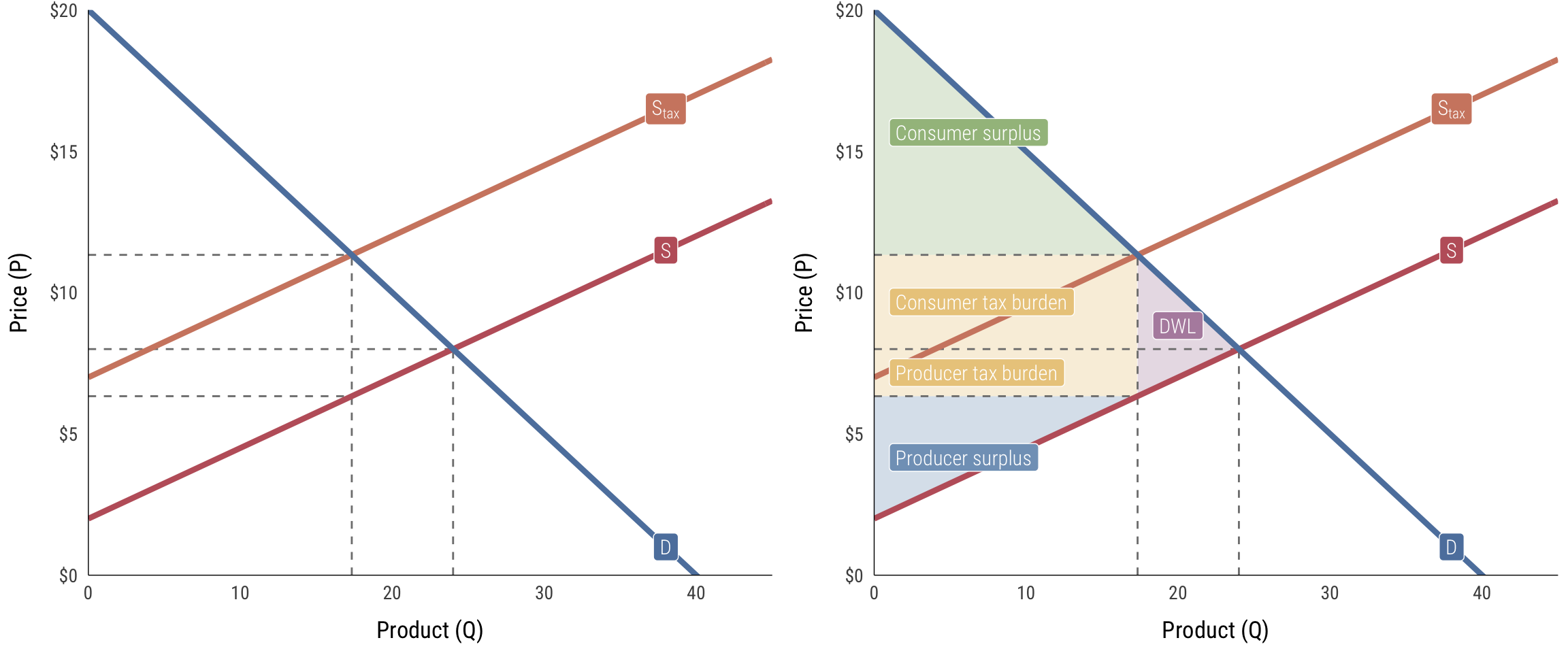

Supply and demand with regular elasticity

This is the first example we did together in class. Both supply and demand here have normal slopes (i.e. not super steep and not super flat), so their elasticity is fairly average. Here are the equations:

\[ \begin{aligned} \text{S} &: P = 2 + 0.25Q \\ \text{D} &: P = 20 - 0.5Q \\ \text{S}_\text{tax} &: P = 2 + 0.25Q + 5 \end{aligned} \]

- Pre-tax quantity: 24

- Pre-tax price: $8

- Pre-tax consumer surplus: $144 (\(1/2 \times 24 \times 12\))

- Pre-tax producer surplus: $72 (\(1/2 \times 24 \times 6\))

- Post-tax quantity: 17.33

- Post-tax price: $11.33

- Post-tax consumer surplus: $75.11 (\(1/2 \times 17.33 \times 8.67\))

- Post-tax producer surplus: $37.56 (\(1/2 \times 17.33 \times 4.33\))

- Deadweight loss: $16.67 (\(1/2 \times 6.67 \times 5\))

- Total tax incidence (revenue raised): $86.67 (\((11.33 - 6.33) \times 17.33\))

- Consumer tax incidence: $57.78 (\((11.33 - 8) \times 17.33\))

- Producer tax incidence: $28.89 (\((8 - 6.33) \times 17.33\))

- Percent of tax borne by consumers: 66.7% (\(57.78 / 86.67\))

- Percent of tax borne by producers: 33.3% (\(28.89 / 86.67\))

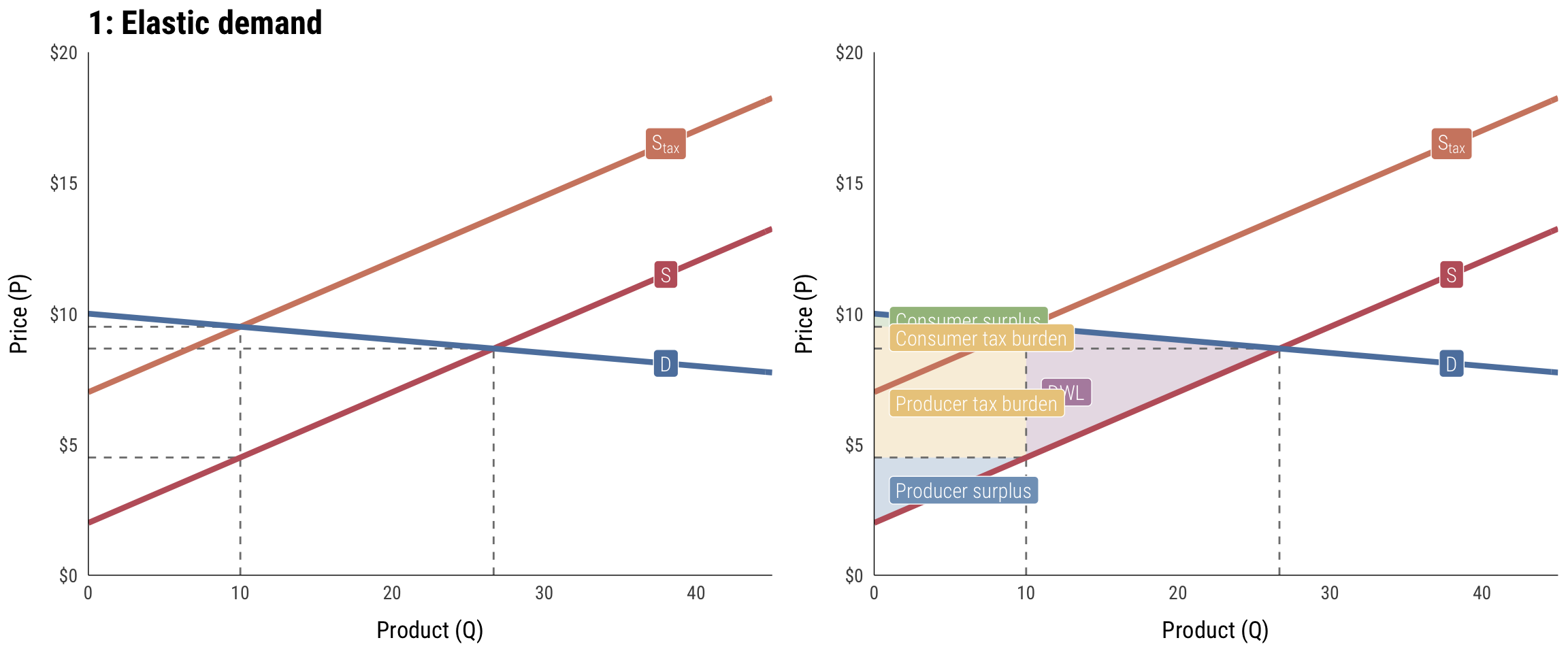

Elastic demand

Here, demand is highly elastic—as the price changes, people change their consumption of the good quickly (i.e. increasing the price makes people jump away from it). Because of this, the burden of the tax falls on the producers, who can’t escape the tax. The tax also causes a lot of DWL because of the high elasticity.

\[ \begin{aligned} \text{S} &: P = 2 + 0.25Q \\ \text{D} &: P = 10 - 0.05Q \\ \text{S}_\text{tax} &: P = 2 + 0.25Q + 5 \end{aligned} \]

- Pre-tax quantity: 26.67

- Pre-tax price: $8.67

- Pre-tax consumer surplus: $17.78 (\(1/2 \times 26.67 \times 1.33\))

- Pre-tax producer surplus: $88.89 (\(1/2 \times 26.67 \times 6.67\))

- Post-tax quantity: 10

- Post-tax price: $9.5

- Post-tax consumer surplus: $2.5 (\(1/2 \times 10 \times 0.5\))

- Post-tax producer surplus: $12.5 (\(1/2 \times 10 \times 2.5\))

- Deadweight loss: $41.67 (\(1/2 \times 16.67 \times 5\))

- Total tax incidence (revenue raised): $50 (\((9.5 - 4.5) \times 10\))

- Consumer tax incidence: $8.33 (\((9.5 - 8.67) \times 10\))

- Producer tax incidence: $41.67 (\((8.67 - 4.5) \times 10\))

- Percent of tax borne by consumers: 16.7% (\(8.33 / 50\))

- Percent of tax borne by producers: 83.3% (\(41.67 / 50\))

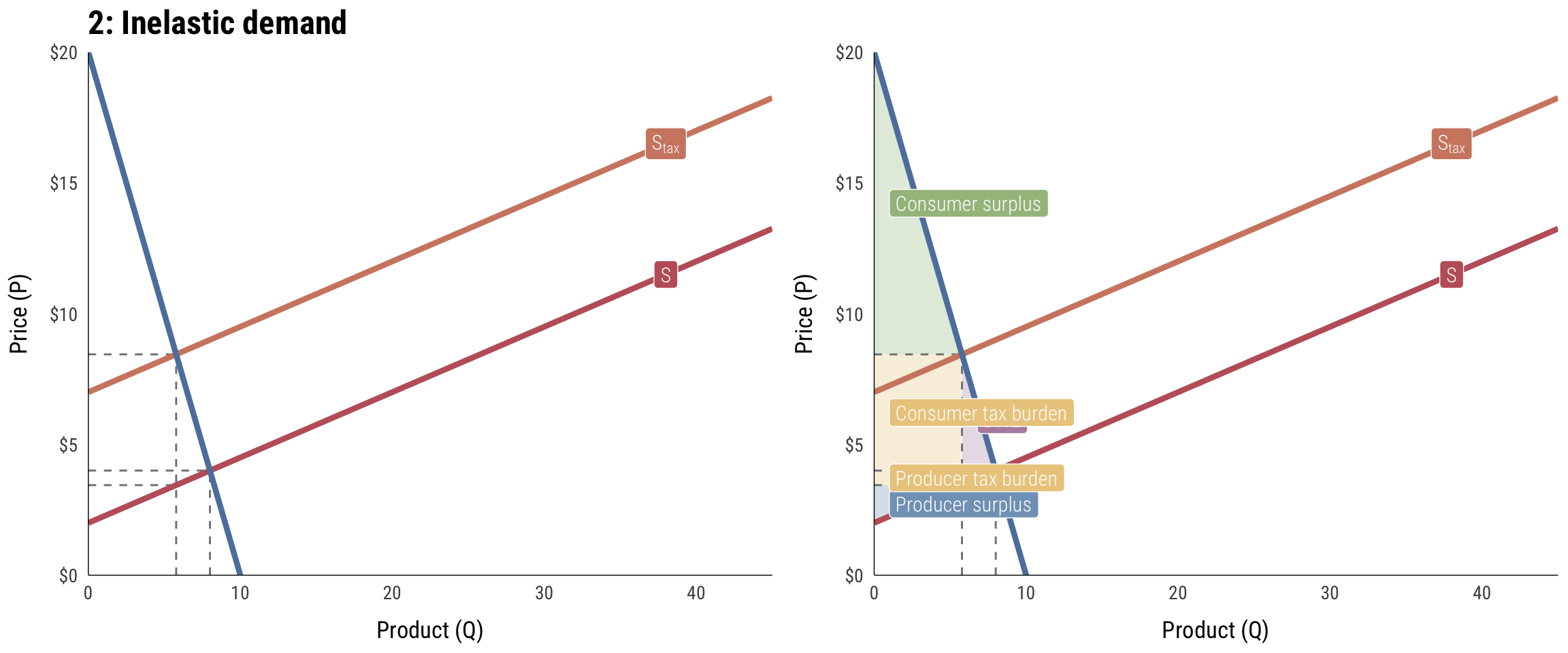

Inelastic demand

Here, demand is highly inelastic—as the price changes, the quantity doesn’t change a lot (i.e. increasing the price makes only a few people jump away, and the people who keep buying it have to suck up the higher price). Because of this, the burden of the tax falls on the consumers, who can’t escape the tax. The tax also causes smaller DWL because of the low elasticity.

\[ \begin{aligned} \text{S} &: P = 2 + 0.25Q \\ \text{D} &: P = 20 - 2Q \\ \text{S}_\text{tax} &: P = 2 + 0.25Q + 5 \end{aligned} \]

- Pre-tax quantity: 8

- Pre-tax price: $4

- Pre-tax consumer surplus: $64 (\(1/2 \times 8 \times 16\))

- Pre-tax producer surplus: $8 (\(1/2 \times 8 \times 2\))

- Post-tax quantity: 5.78

- Post-tax price: $8.44

- Post-tax consumer surplus: $33.38 (\(1/2 \times 5.78 \times 11.56\))

- Post-tax producer surplus: $4.17 (\(1/2 \times 5.78 \times 1.44\))

- Deadweight loss: $5.56 (\(1/2 \times 2.22 \times 5\))

- Total tax incidence (revenue raised): $28.89 (\((8.44 - 3.44) \times 5.78\))

- Consumer tax incidence: $25.68 (\((8.44 - 4) \times 5.78\))

- Producer tax incidence: $3.21 (\((4 - 3.44) \times 5.78\))

- Percent of tax borne by consumers: 88.9% (\(25.68 / 28.89\))

- Percent of tax borne by producers: 11.1% (\(3.21 / 28.89\))

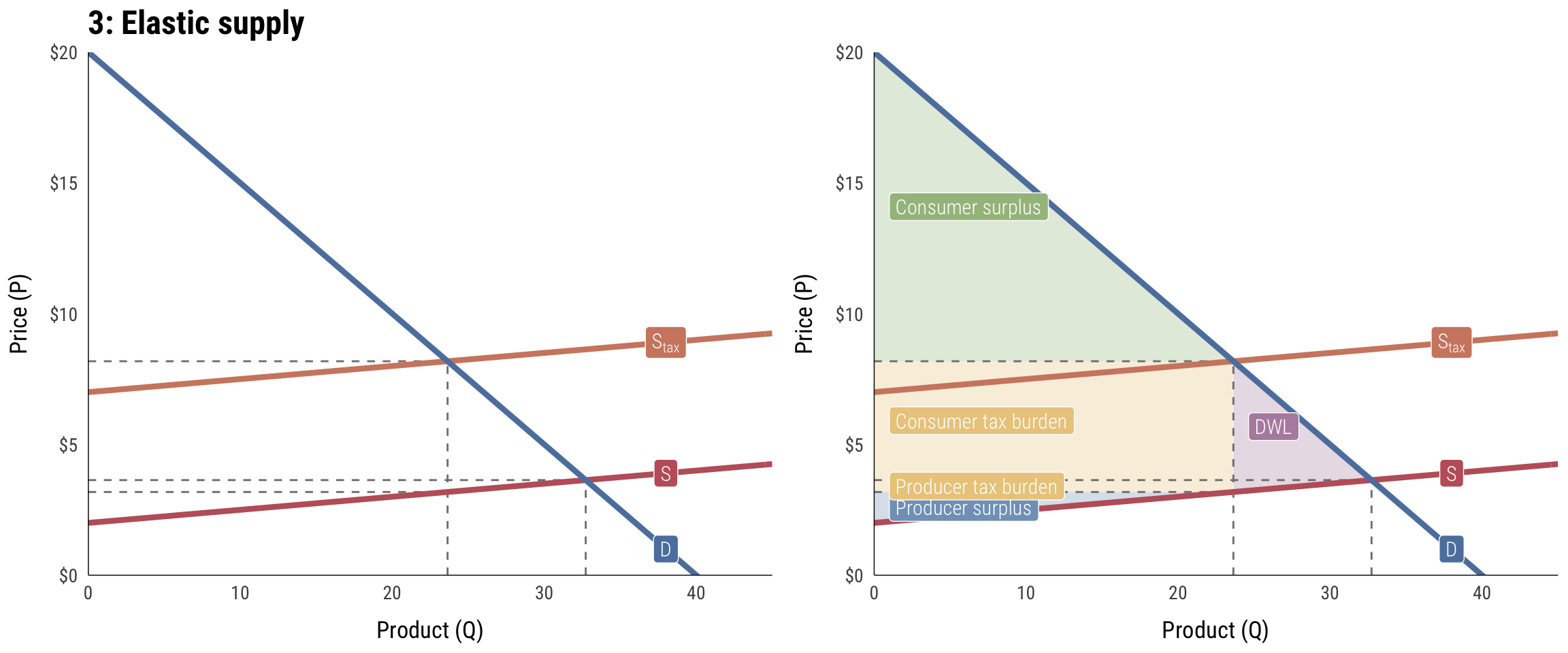

Elastic supply

Here, supply is highly elastic—as the price changes, the quantity produced changes a lot (i.e. increasing a tax on books would make Amazon redirect its efforts to music, video, or web servers and wouldn’t hurt the company that much). Because of this, the burden of the tax falls on the consumers, since the company escapes the tax easily. The tax also causes a lot of DWL because of the high elasticity.

\[ \begin{aligned} \text{S} &: P = 2 + 0.05Q \\ \text{D} &: P = 20 - 0.5Q \\ \text{S}_\text{tax} &: P = 2 + 0.05Q + 5 \end{aligned} \]

- Pre-tax quantity: 32.73

- Pre-tax price: $3.64

- Pre-tax consumer surplus: $267.77 (\(1/2 \times 32.73 \times 16.36\))

- Pre-tax producer surplus: $26.78 (\(1/2 \times 32.73 \times 1.64\))

- Post-tax quantity: 23.64

- Post-tax price: $8.18

- Post-tax consumer surplus: $139.67 (\(1/2 \times 23.64 \times 11.82\))

- Post-tax producer surplus: $13.97 (\(1/2 \times 23.64 \times 1.18\))

- Deadweight loss: $22.73 (\(1/2 \times 9.09 \times 5\))

- Total tax incidence (revenue raised): $118.18 (\((8.18 - 3.18) \times 23.64\))

- Consumer tax incidence: $107.44 (\((8.18 - 3.64) \times 23.64\))

- Producer tax incidence: $10.74 (\((3.64 - 3.18) \times 23.64\))

- Percent of tax borne by consumers: 90.9% (\(107.44 / 118.18\))

- Percent of tax borne by producers: 9.09% (\(10.74 / 118.18\))

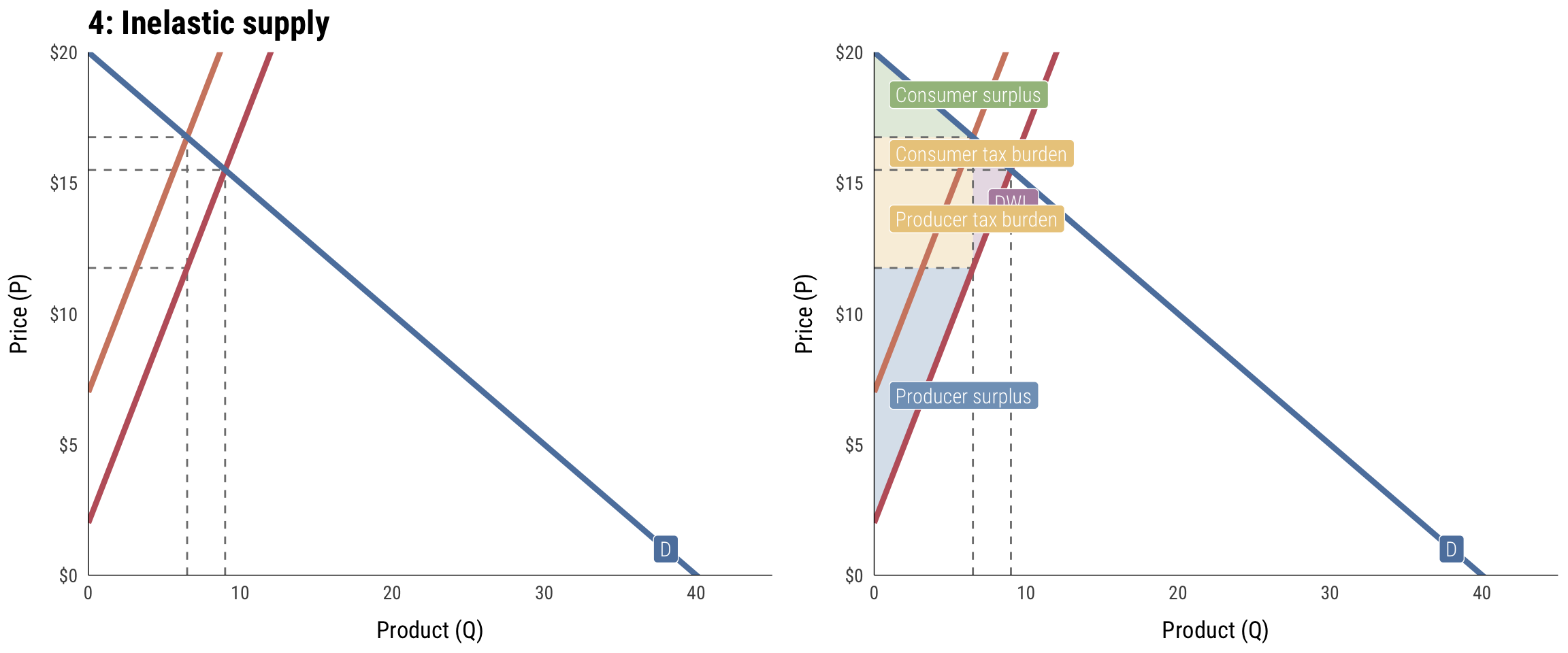

Inelastic supply

Here, supply is highly inelastic—as the price changes, the quantity produced changes a little (i.e. increasing a tax on books would put strain on a small family-owned bookstore that only sold books, since they’d have no other alternative things to produce). Because of this, the burden of the tax falls on the producers, since the company can’t escape the tax by doing other things.

\[ \begin{aligned} \text{S} &: P = 2 + 1.5Q \\ \text{D} &: P = 20 - 0.5Q \\ \text{S}_\text{tax} &: P = 2 + 1.5Q + 5 \end{aligned} \]

- Pre-tax quantity: 9

- Pre-tax price: $15.5

- Pre-tax consumer surplus: $20.25 (\(1/2 \times 9 \times 4.5\))

- Pre-tax producer surplus: $60.75 (\(1/2 \times 9 \times 13.5\))

- Post-tax quantity: 6.5

- Post-tax price: $16.75

- Post-tax consumer surplus: $10.56 (\(1/2 \times 6.5 \times 3.25\))

- Post-tax producer surplus: $31.69 (\(1/2 \times 6.5 \times 9.75\))

- Deadweight loss: $6.25 (\(1/2 \times 2.5 \times 5\))

- Total tax incidence (revenue raised): $32.5 (\((16.75 - 11.75) \times 6.5\))

- Consumer tax incidence: $8.12 (\((16.75 - 15.5) \times 6.5\))

- Producer tax incidence: $24.38 (\((15.5 - 11.75) \times 6.5\))

- Percent of tax borne by consumers: 25.0% (\(8.12 / 32.5\))

- Percent of tax borne by producers: 75.0% (\(24.38 / 32.5\))

Clearest and muddiest things

Go to this form and answer these three questions:

- What was the muddiest thing from class today? What are you still wondering about?

- What was the clearest thing from class today?

- What was the most exciting thing you learned?

I’ll compile the questions and send out answers after class.